st louis county personal property tax on car

Charles County Revenue Collector said last year that personal property taxes generated 115 million for St. 15000 market value 3 5000 assessed value Taxes are imposed on the assessed value.

Missouri Has One Of The Highest Vehicle Property Tax Rates In The Nation Lake Of The Ozarks Politics Government Lakeexpo Com

Heres a breakdown of where the money was allocated.

. The assessment is made as of January 1 for the current years tax and is predicated on 33 13 of true value. County Parish Government Government Offices Federal Government. The good news is that tax can be claimed when you file.

To declare your personal property declare online by April 1st or download the printable forms. You are in an active bankruptcy Form 4491. Vehicle values are based on the average trade-in value as published by the National Automobile Dealers Association RSMo 1371159 wwwmogamogov.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Personal property account numbers begin with the letter I like in Individual followed by numbers. Ann 63074 The Crossings at Northwest.

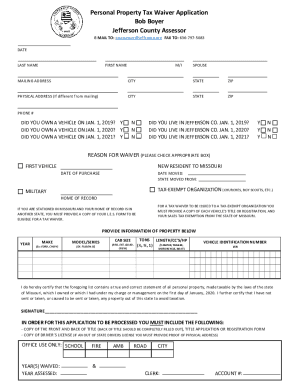

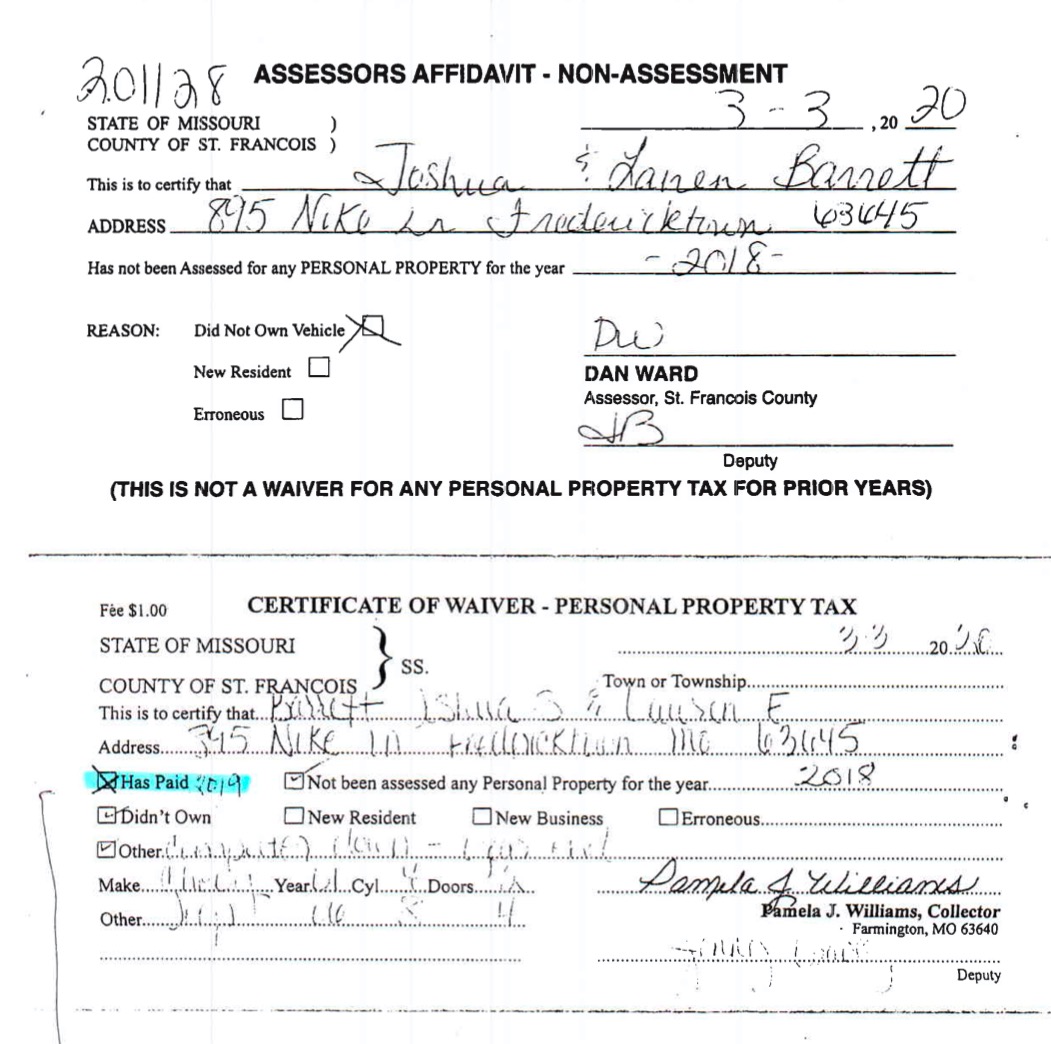

LOUIS COUNTY PARKS MOUNTED PATROL - ADVENTURE IN EVERY ACRE. There is an assessment rate for personal property on average of 33 13 percent across the country. You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous years.

Paid Personal Property Tax Receipts. The leasing company will be billed for personal property tax directly. The value of your personal property is assessed by the Assessors Office.

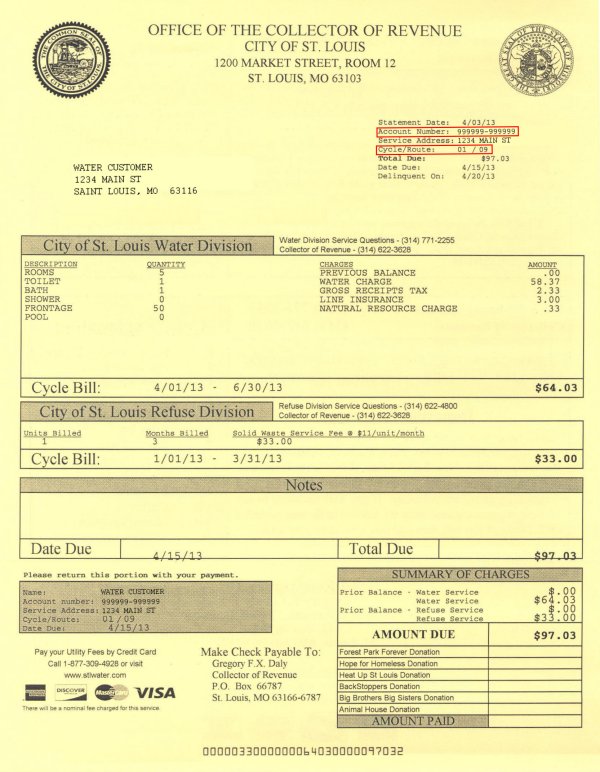

LOUIS Personal property tax bills are showing up in mailboxes across the area and you may notice you owe more on your vehicle this year. The Personal Property Department collects taxes on all motorized vehicles boats recreational vehicles motorcycles and business property. Every person owning or holding real property or tangible personal property on the first day of January including all such property purchased on that day shall be liable for taxes thereon during the.

All City of St. State Tax Commission 437 SW2d 665 668 Mo. Louis taxpayers with tangible property are mandated by State law to file a list of all taxable tangible personal property by April 1st of each year with the Assessors Office.

Louis County has been mailing out yellow slips stating the change with real estate and personal property tax bills. Louis MO 63104 A branch of Roos County government is located at 41 South Central Ave Clayton MO 63105-2125. Search by Account Number or Address.

Nov 22 2021 0406 PM CST. County Parish Government. St Louis County Ecc.

Where Can I Pay My Personal Property Tax In St Louis County. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. Louis County Revenue Department collects taxes on both real estate and personal property such as cars and recreational vehicles.

Personal property tax waivers Personal property accountstax bill adjustment add or remove vehicle Pay taxes EXCEPT for delinquent real estate taxes 2017 and older. You must present the receipts an original photocopy fax copy or copy of an internet confirmation screen is acceptable when you obtain license plates. 168 N Meramec Ave.

The median property tax on a 17930000 house is 224125 in St. How Do I Pay My St Louis County Personal Property Tax. Your county or the city of St.

8am 430pm M F. Louis Irresistible 500 NW Plaza Dr St. Louis County The median property tax on a 17930000 house is 163163 in Missouri The median property tax on a 17930000 house is 188265 in the United States.

65129 the government office is located at 4546 Lemay Ferry Road. 2 days agoThe St. Clayton Community Bank is located at 711 South Broadway Suite 101 Clayton CA 63105.

Saint Louis County Personal Property Tax. Personal property is assessed at 33 and one-third percent one third of its value. 8am 430pm Services Offered.

Louis County Parks Mounted Patrol. About the Personal Property Tax. You moved to Missouri from out-of-state.

Your feedback was not sent. Subtract these values if any from the sale. If you have questions about whether your vehicle was taxed or the value please contact the Leasing Section at 314-615-5102.

You pay tax on the sale price of the unit less any trade-in or rebate. Louis MO 63129 Check cash money order Check cash money order M F. Leave this field blank.

This is your first vehicle. A community located at 500 NW Plaza Dr. Have you met Storm and Bemo of our St.

By adding the estimated Market Value or its market value to the projected value 33 13. Louis collectors office sent you receipts when you paid your personal property taxes. You can spot them most often at Queeny Park Lone Elk Park and Greensfelder Park.

You can also obtain a receipt for 100 at one of our offices. The estimated taxable value is determined by multiplying the estimate of. Saint Louis MO 63105.

Online declarations are available no later than the last day of January through April 1 of. If you opt to visit in person please schedule an appointment. An estimate of the propertys assessed value can be determined in two ways.

Collector of Revenue FAQs. These tax bills are mailed to citizens in November and taxes are due by December 31st of each year.

County Assessor St Louis County Website

Declare Personal Property St Louis County Fill Online Printable Fillable Blank Pdffiller

Print Tax Receipts St Louis County Website

2019 Form Mo Personal Property Tax Waiver Application Jefferson County Fill Online Printable Fillable Blank Pdffiller

Services St Louis County Website

2022 Best Places To Buy A House In St Louis Area Niche

Collector Of Revenue Faqs St Louis County Website

Barrett S Problems Compounding In 3rd District Senate Race

Missouri Vehicle Registration Of New Used Vehicles Faq

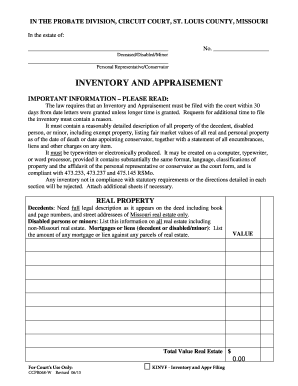

St Louis County Probate Court Forms Fill Out And Sign Printable Pdf Template Signnow

Online Payments And Forms St Louis County Website

Temp Tags New Missouri Vehicle Sales Tax Law Takes Effect In August Fox 4 Kansas City Wdaf Tv News Weather Sports

Waiting On Your Tax Bill St Louis County Says Printing Issue Delayed Mailing Vendor Says County Sent Files Late Politics Stltoday Com

Action Plan For Walking And Biking St Louis County Website

Online Payments And Forms St Louis County Website

Personal Property Declaration St Louis County Fill And Sign Printable Template Online Us Legal Forms